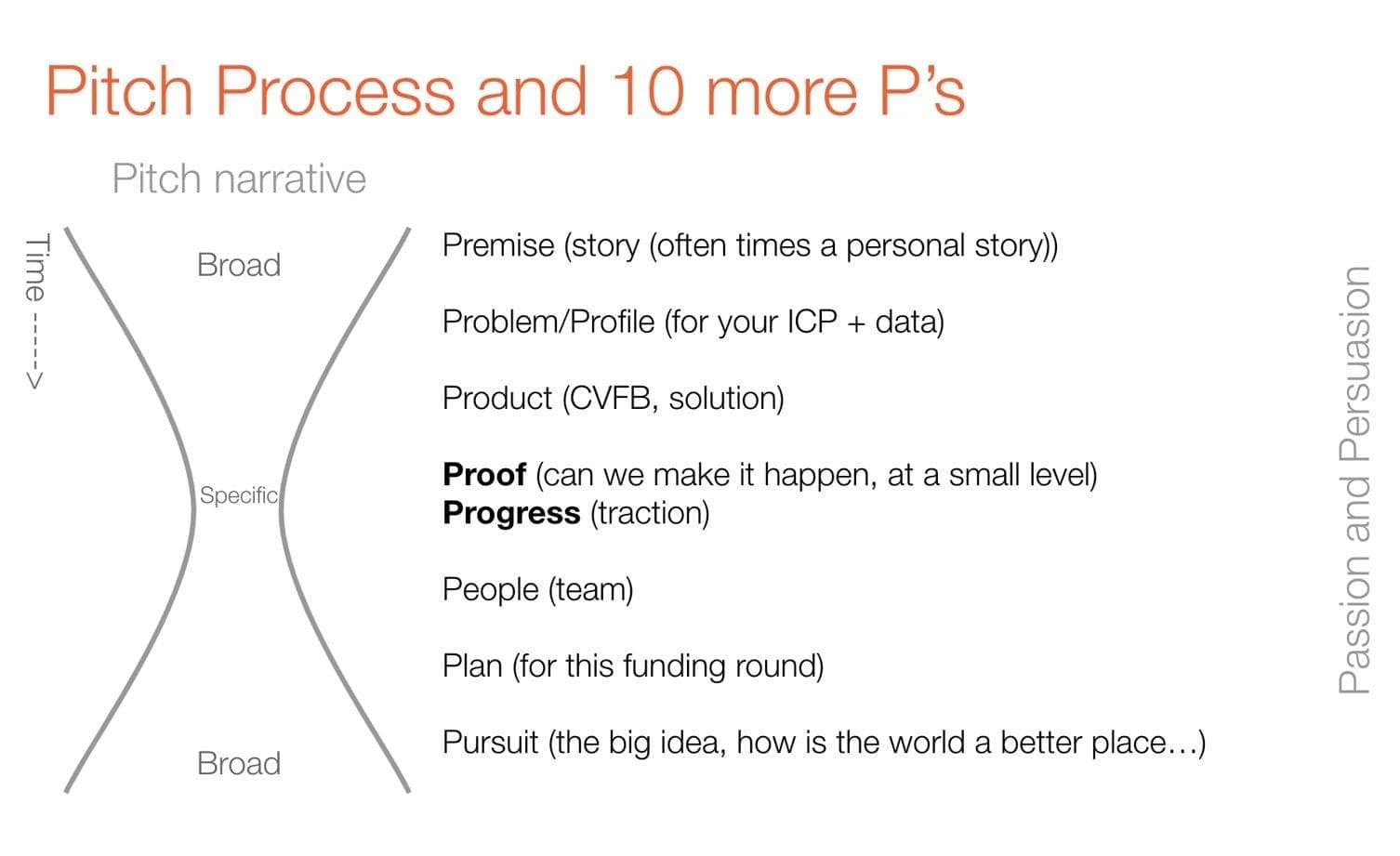

Creating a great startup investor pitch - the “hourglass approach” and 10Ps

As an entrepreneur, securing funding is one of the most critical steps in bringing your idea to life. The pitch process is your opportunity to convince investors that your startup has potential. While there are many examples of presentation decks online, I developed a version of a way to think about the pitch and the associated presentation, aka the investor deck.

Before you get going, I suggest you do a version of the CVFB framework for your company. This is a simple way to hit many of the key aspects of your company and will be a good foundation for creating a pitch. As a bonus, a CVFB will also be a good foundation for future elevator pitches.

As we think about the pitch and deck, here’s a breakdown of the essential elements you need to include in your pitch;

- Personal story - who are you, and what led you to work on this idea? Be crisp and pull specific aspects from your past that suggest a successful future. Try to make the narrative memorable.

- Premise: Building on your personal story and insight, what is the premise of what you are working on? This section is often aided by a "databit" that indicates a very large problem space. For example, "In 2020, more than 1.9 million new cases of colorectal cancer were estimated to have occurred worldwide. The World Health Organization (WHO) estimates that by 2040, the number of new cases will increase to 3.2 million per year. It is the fourth leading cause of death". Before you narrow into the actual problem space, the investor already has a pretty good idea of where you are going.

- Problem/Profile: Clearly define the problem you're solving and profile your Ideal Customer Profile (ICP) with relevant data. This section should include real customer examples and quotes from your customer discovery and foreshadow your customer traction slide, which will follow later. Try hard to quantify the customer's "pain."

- Product/solution: Introduce the solution, the product… You can record a video demo of the product and speak over it, highlighting the core, unique or differentiated features, or even do a live demo. Showing is much better than telling!

- Proof: Provide evidence that your solution can succeed, even at a small scale. Who is using the alpha product? What are they saying? What stats do you have from product usage that suggest your early users like what you've built for them? Do you have any paying customers?

- Progress: Highlight the traction your startup has gained so far, whether it’s user growth or revenue. Be specific on who is buying and why. Did you compete and win against a competitor? You will need a competitive slide, and I like it here. It highlights why we are winning now and how hard it will be for the other players (incumbents and other startups) to compete.

- People: Showcase your team’s expertise and why they’re uniquely qualified to execute this vision. It's best to pull out very specific and relevant past experiences that suggest you can win in this new one. Every investor wants to bet on people who have shown an ability to achieve and win in the past.

- Plan: What’s next, assuming you get the investment? Outline how the funds will be used to reach your next milestone. Include KPIs including time frame (e.g., 18 months), customer growth (going from X to Y), revenue targets (e.g., we expect to get to XX MRR), team size, critical hires…basically “what progress is the investor buying” with their investment. Is it credible and exciting progress?

- Pursuit: Finish with the big picture—how you could, if all things go well, make a very large company and a very large impact. And, I do encourage entrepreneurs to answer the question…”if we are successful, how is the world a better place?” Another way to work this slide is to start with “imagine….” to get the investor thinking about how big this company could be and what the future could look like.

- Passion: Convey the passion that drives you and your team to solve this problem, which can often inspire investors to believe in your vision. If your're not excited about it now, they won't be either!

- Persuasion: Use your narrative skills to persuade investors that your startup is not just viable but a necessary innovation in its field. This is an area where you can deal with questions and objections too and slowly persuade the investor about you, the idea and their opportunity to be a meaningful part of something big and important.

In addition to the content, consider the shape of the "hourglass" too. You can start with a big-picture problem or solution, but you should get very narrow, often with one specific customer example. Then, you can build on the single customer, into early customer traction and then into winning in a competitive market, then onto a bigger vision for the future. But, please, please, please get narrow enough for the investor to understand the business with a unit of one.

As you actually craft a deck, you can also "block" out the slides and the time you want to spend in each area. Some companies have stronger teams, some stronger traction, some better ways to acquire customers, some a big or small TAM, some a strong or weaker competitive positioning...As you identify these strengths and weaknesses, consider where during the presentation you are going to focus on them and make sure you have the appropriate time for each.

Additionally, consider drawing this hourglass on a whiteboard. For each section, write the headline of the slide. If you only read the headlines, how strong is the story? Keep working on the headlines, and then once you feel good about the overall narrative, you can really craft the slides.

Finally, once you start presenting this to investors, you are likely to need to iterate based on the most common objections and things investors "take away". Make sure you hit the strongest points at the beginning, middle and end, but from different vantage points, reminding them that you are the right team to bet on to go after this problem and market.

By structuring your pitch around these points, you present a clear and compelling narrative and demonstrate to investors that you’ve thought through every aspect of your business. Remember, passion and persuasion are essential throughout this process.